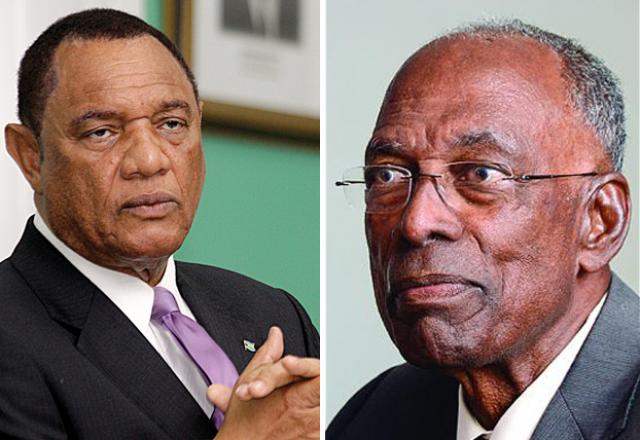

The country’s current tax structure is unfair, regressive and needs to be modernized to evenly distribute the burden between the wealthy and the poor, Prime Minister Perry Christie told the House of Assembly.

The country’s current tax structure is unfair, regressive and needs to be modernized to evenly distribute the burden between the wealthy and the poor, Prime Minister Perry Christie told the House of Assembly.

Christie revealed the government’s plans to institute a value added tax (VAT) system on July 1, 2014. The VAT rate will be set at 15 percent, consistent with rates in other countries, according to the government’s white paper on tax reform.

Christie said the government plans to overhaul the tax system in order to secure an adequate revenue base; create a tax system that promotes stronger economic growth and make the tax system more equitable.

He said the implementation of VAT will lead to reductions in import duty rates as the country accedes to the World Trade Organization (WTO) and reduce excise tax rates.

The government also proposes to eliminate business license tax, as currently structured, and to replace the hotel occupancy tax once VAT is implemented, he said.

“By predominantly focusing on goods our tax system is out of balance with international norms,” Christie said. “It does not share the tax burden with those who are providing services in a way that is fair or adequate.

“Moreover, a goods centric taxation system is inherently unfair as it makes the poor, struggling Bahamian pay the same in taxes as the wealthier citizen does. In short, the current tax system is regressive.

“In distributing the tax burden it takes no account of varying levels of means within our society. Reform of the tax system is therefore essential. Indeed, the need for it is becoming more urgent with each passing year.”

Christie said initiatives are underway to improve revenue collection by the Department of Customs and collection by the real property tax office. He said the government is also considering the establishment of a revenue collection agency.

In September, former Minister of State for Finance Zhivargo Laing said the government’s planned tax reform is “nothing new”. He said instituting VAT and reforming property tax collections were proposals conceived under the Ingraham administration.

By Taneka Thompson

Guardian Senior Reporter