Towards the end of market trading on Tuesday, Research in Motion temporarily froze its shares to deliver the inevitable news: the BlackBerry maker was in deep financial trouble and was no longer generating profit.

A profit loss means RIM is no longer a functioning business. It’s a dead weight around Canada’s neck.

The terrifying thing is that RIM saw this coming and did nothing. It only shouted, “train!” as the company was being hit by he train.

RIM hedged its bets on BlackBerry 10, its forthcoming operating system, along with its new range of smartphones. Whether or not RIM can survive until then remains unclear. Many think not. Some believe the company can keep going under the wing of a new owner.

The value of RIM shares have been down more than 75 percent over the past twelve months, and continues to slowly drop. It was trading as high as $70 a share in May last year but its share price dramatically fell in the face of aggressively competing rival smartphones.

RIM went from a company worth $78 billion in mid-2008 to one that barely scraps the bottom of the barrel at $5.2 billion today. It has lost more than 90 percent of its value.

RIM ran out of fuel, and ran on fumes for mere days before it totalled below the 2 percent profit loss mark. The company is in utter free fall and there seems to be nothing stopping RIM slipping further into trouble.

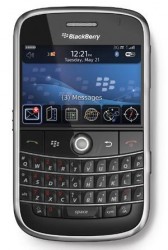

RIM has two areas: its smartphone sector and its data infrastructure. BlackBerrys are useless without the data infrastructure, meaning if RIM goes bust and fails to sell its data networks, more than 78 million people will suddenly lose service. RIM may have nothing left to lose but its customers certainly do.